Market Outlook:

The Nifty climbed to the anticipated range between 10700 and 11000 where it was supposed to (from a technical point of view) face a lot of supply pressure. It is just happening that way—it is quite unlikely that unless the market gets any significant boost either from a major improvement in earnings or from the impending union budget, the Nifty would decisively take out this range. On the other hand, disappointment in terms of earnings expectation and getting spooked by any move in the form of any measures from the government like tweaking and/or overhauling the capital gains tax regime adversely affecting investor sentiment would usher in the much-needed correction that simply did not happen in 2017.

Having said that we would like to re-state what we said earlier: even in an otherwise highly overheated market there would be pockets where valuations have not become that stretched, and we can still find some investment opportunities—arguably for the medium to long-term—where we can get such stocks that offer low risk with potentially high gain opportunities fulfilling our motto of “Heads I Win Big Tails I Don’t lose Much.”

Today, we present two such opportunities for the medium to long term.

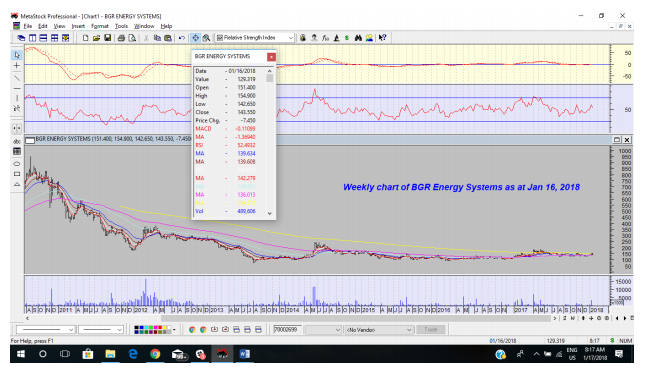

BGR Energy Systems (143.55):

Buy; Stop Loss below 110 on closing price basis. Targets for medium term would be the range between 190 and 240; the same for long term: first 330 and then 475–these are for two-to-three-year time horizon.

Advanced Enzyme Technologies (305.20):

This stock has already completed its bottom formation and is now moving up; however, there is likely to be a short-term correction here, which is likely to take the stock to our suggested buying range between 305 and 285. Buy it anywhere within this range with closing price stop below 250. Medium term target would be 360 – 375 and first long-term target would be the range between 430 and 450. Three year target would be 550 – 570.

Standard Disclosure & Disclaimer: Take positions in the above counters with strict risk control measures in terms of strict stop-loss adherence and position-sizing should be as per the movement favourable or adverse—if favourable a large position but smaller bets are better in case of either high volatility or adverse movement.