They are almost all from the tech sector

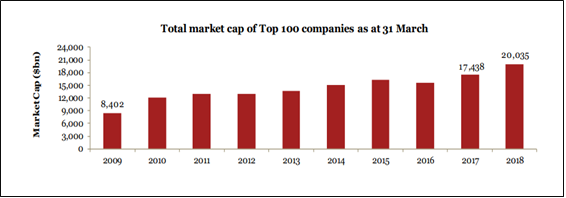

According to a recent study done by Price Waterhouse Coopers, the global market capitalization of the top 100 companies has increased by nearly $11.5 trillion in the last 9 years since the financial crisis. But what is striking is the dominance of a handful of stocks.

Looks like tech all the way…

If there is one big trend in the market cap gains since the financial crisis, it is the rise of digital. In fact, just the top 7 digital companies in the world have contributed to more than 50% of this market cap gain of $11.5 trillion since the Lehman crisis. These include Apple, Amazon, Alphabet (Google), Microsoft, Facebook, Alibaba and Tencent. It is these 7 digital companies that account for most of the market cap gains since the Lehman crisis. There are odd banks like JP Morgan and Wells Fargo or an odd pharma company like J&J. But the principal story of the market cap shift in the last 10 years since the crisis has been all about digital technologies.

Two major trends are visible

The PWC report is interesting and insightful in a number of ways. For example, the technology stocks with a combined market cap of $4.8 trillion dominate the market cap stakes for the first time overtaking financials at $4.4 trillion market cap. There are 2 very specific trends that are visible. There is a clear shift from old economy to the digital new economy. The top list is dominated by technology companies. Even Berkshire Hathaway has Apple as its largest single shareholding. JPM is the one that survived the crisis and J&J is positioned as a biotech company. Essentially, it is all about new generation ideas. Secondly, China is making its presence felt in the global scene. The two large companies that dropped out of the Top-10 were Exxon and Wells Fargo of the US. The two new companies that came into the top-10 list were Tencent and Alibaba of China. That probably says it all about the silent value shift happening globally!