What went wrong with the Small Finance Bank stricture

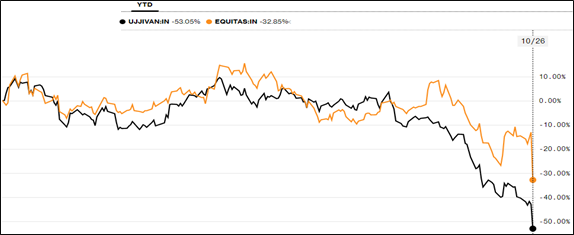

If you look at the price charts of two recent MFI listings (Ujjivan and Equitas), both stocks are quoting below their issue price. But the real price damage has happened after the recent RBI ruling. So what exactly was that?

No holding company please!

Currently, both Equitas and Ujjivan have a small finance bank (SFB) license and both are operating these small banks as a subsidiary of its holding company. RBI has now clarified that the holding company model will not be valid for SFBs and both the companies will have to look at listing their SFBs as separate entities within 3 years of starting operations. On Friday, both the stocks were down by nearly 20%. This ruling is nothing new as RBI’s stance on this subject is already well known. They why did the two stocks react so violently to the RBI ruling? Is there something larger than the announcement here.

What about shareholders?

That appears to be the million dollar question at this point of time. Under the RBI regulations, both the companies will have to list their SFP arms between 2019 and 2020. Moreover, the promoters of the SFB will continue to hold at least 40% of the SFB for a period of 5 years after which they will be allowed to dilute their stake. This is likely to create an anomaly because the shares will now start to quote at a discount to the actual price due to the SFB business going outside. Unless, the shareholders get proportionate allotment in the SFB, they will be forced to face up to value destruction for shareholders. Additionally, there is also an element of uncertainty regarding issues like whether RBI plans more stringent regulation of SFBs. That will be negative. Currently, Equitas and Ujjivan are in a state of flux. Value destruction may have already happened!