FAQs

Most Frequently Asked Questions

| Most Frequently Asked Questions | |||

| Section | Questions | Answers | |

| Account Opening | How can I open an account with Achiievers Equities Ltd? | You can click on the open an account button provided on our website www.achiieversequitiesltd.com and leave us your contact details. Our representative will visit you to complete the account opening formalities.To access directly Click Here | |

| Account Opening | Why should I open an account with Achiievers Equities Ltd? | Achiievers Equities Ltd offers you the most transparent and lowest brokerage in the industry, so that you can trade freely without bothering about cost of brokerage, in addition to your trade, without compromising on service and quality. To know more about why should you should choose Achiievers Equities Ltd please visit our website and click “About Us” and other sections. | |

| Account Opening | What is a 3-in-1 account? | 3-in-1 is an integrated Savings, Demat and Trading account. This ensures that the funds and/or shares are directly debited and/or credited to /from your account .This enables you to trade without going through the hassles and paperwork and maintains transparency in the transactions. | |

| Account Opening | Can I open a NRI account with you ? | Yes we have NRI facility. | |

| Account Opening | What are the value added services offered by Achiievers Equities Ltd? | Achiievers Equities Ltd offers the following Value Added Services1. Trade on Phone / Online / through Mobile. 2. Customized mobile / email alerts.

3. Customised Research Reports, Charts and Tools. 4. Powerful tools like Predefined and customized Screeners for effective equity research 5. Stay Updated with Portfolio Tracker. 6. Online Fund Transfer with more than 40 Banks. |

|

| Account Opening | What are the different products offered by Achiievers Equities Ltd? | Equities / Derivatives / Commodity / NSE Currency /MF/ Inurance / IPO / Bonds/FDs | |

| Account Opening | What are the documents required for opening a 3-in-1 Account for Individual/ Sole Proprietorship Firm/ Partnership Firm/ HUF(Hindu Undivided Family)/ Trust/ AOP(Association Of Persons)? | ( Link file Doc for Trading acc) to be pasted. | |

| Account Opening | I have a Demat account with other depository. Can I use this account or will I have to open a new Demat account to link with Achiievers Equities Ltd trading account? | No, You have to open a New Demat account with Achiievers Equities Ltd | |

| Account Opening | I have a Savings account and Demat account with another Bank or Depository? Can I link these accounts to the trading account ? | You can link the Savings account, but you have to open a new Demat account with Achiievers Equities Ltd to enjoy the 3-in-1 trading experience. | |

| Account Opening | I do not have access to internet every time. Is there any other way I can place orders? | Yes, you may call at 03366063021/22/23/24 for Equity & 03366063008/3009/3010 for Commodity to transact through our Trade-on-Phone facility and its absolutely Free | |

| Account Opening | What type of Bank Account can I use with my Achiievers Equities Ltd Trading account? | Any savings bank account can be linked to Achiievers Equities Ltd trading account. | |

| Account Opening | Can I have multiple Bank accounts linked to my Achiievers Equities Ltd Trading account? | Yes, you can link more than one Bank account to your Achiievers Equities Ltd Trading account, one should be primary & others secondary. | |

| Account Opening | Do I have to maintain a minimum balance in my Bank Account? | The minimum balance requirement in the account would depend on the Banks and there account opening scheme selected by you at the time of account opening. | |

| Account Opening | Where do I post my queries related to account opening? | You can post your queries through Customer Service by mailing your queries to customer.care@achiieversequitiesltd.com or customer.care2@achiieversequitiesltd.com or call us on the number 33 66063000 / 3017/ 3020/ 3044 / 18604203333 | |

| Account Opening | I want to change the communication/permanent address. What is the process for the same? | Pls call our customer service or mail to customer.care@achiieversequitiesltd.com and they will guide you with documentations required. You need to provide latest Address and ID proof with modification form. | |

| Account Opening | I want to change the Contact No. registered with Achiievers Equities Ltd. Do I have to submit any proof? What is the process for the same? | Pls call our customer service or mail to customer.care@achiieversequitiesltd.com and they will guide you with documentations required. No proof is required, you have to fill up the modification form. | |

| Account Opening | I want to change the e-mail address registered with Achiievers Equities Ltd. What is the process for the same? | Pls call our customer service or mail to customer.care@achiieversequitiesltd.com and they will guide you with documentations required. No proof is required, you have to fill up the modification form. | |

| Account Opening | I want a Demo of the site before opening the account. | Pls call our customer service or mail to customer.care@achiieversequitiesltd.com or customer.care2@achiieversequitiesltd.com or call us on the number 33 66063000 / 3017/ 3020/ 3044 / 18604203333 for demo user id & password. | |

| Account Opening | How will you do IPV ( In-Person verification) ? | We will contact you after receiving your documents & will complete the IPV as per your suitable time using Skype. | |

| Account Opening | How much time does it take to open an account? | If documents are complete & funding cheque is cleared, then 4-5 days and for urgent cases, in FNO segment, 12 hours after verification of documents and Online Fund Transfer in our account. | |

| Back Office | How do I check my Past Trades ? | You can check your trades from our website using your back office login id. | |

| Back Office | How do I check my Open Positions / Demat Holdings ? | You can check your trades from our website using your back office login id. | |

| Back Office | How do I check my Portfolio ? | You can check your trades from our website using your back office login id. | |

| Back Office | Where can I view my ledger ? | You can check your trades from our website using your back office login id. | |

| Back Office | How to place Payout Request from Back-office? | You can place request (1) Online from Back-Office. Go to Option Menu>Data Entry> Cheque Request (2) Mail us at pay@achiieversequitiesltd.com or customer.care@achiieversequitiesltd.com | |

| Charges | What are the account opening charges? | You have to pay a nominal fees of Rs. 750/- as one time account opening charges to open a normal or a 3-in-1 account with us. | |

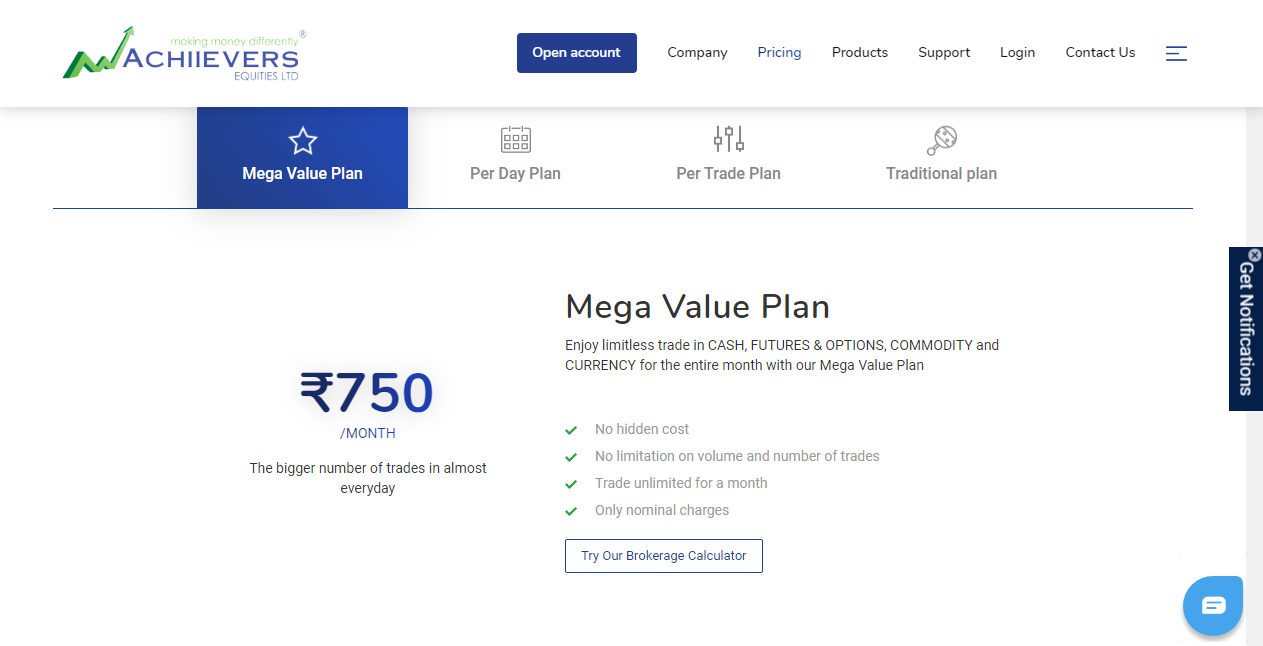

| Charges | What are the different brokerage plans offered by Achiievers Equities Ltd? | Achiievers offers 3 types of brokerage plans: Mega Value Plan, Rs 15 per executed order scheme & Normal Brokerage Plan. Click here | |

| Charges | What is the product wise minimum order value? | There is no productwise minimum order value. | |

| Charges | What is the minimum brokerage charged by Achiievers Equities Ltd? | Achiievers offers 3 types of brokerage plans: Mega Value Plan, Rs 15 per executed order scheme & Normal Brokerage Plan. Click here. | |

| Charges | Can I switch from one plan to the other plan? | (1) Mega value Plan to Normal/ Default brokerage plan–Allowed. (2) Rs. 15 per Executed Order to Normal / Default–Allowed . (3) Normal to Mega Value- Not Allowed. (4) Normal to Rs.15 per Executed Order–Not Allowed (5) MVP Plan to Rs. 15 per Executed Order & Vice Versa –Not Allowed | |

| Charges | How can I place the switch request? | Pls call our customer service at 18604203333 or mail to customer.care@achiiversequitiesltd.com | |

| Demat | Can we see demat charges in contract notes? | No . The charges are posted in trading ledger & you can check the same from your back office login id. | |

| Demat | What is the Demat AMC per year ? | Rs 400 + service tax @ 12.36%. | |

| Demat | Why is a Power of Attorney (POA) for Demat Account req | POA is required for the smooth functioning of the demat account. Everytime you sell the shares, we use the POA to debit the shares from your demat account and provide it to the exchange. POA is also used to debit shares from your demat account when you intend to pledge them to get collateral margin for trading futures and options | |

| Demat | Who is your Depository? | We have our Depository in CDSL. | |

| Fund Transfer | What are the charges for Fund Transfer ? | You have to pay a nominal fee of Rs 8/- plus Service Tax per transaction when using our fund transfer option from website,it will be directly debited by the service porvider. | |

| Fund Transfer | How do I do fund transfer in your Account ? | You can transfer fund from our website using 40 banks payment gateway system. | |

| Fund Transfer | How Long does it take to credit my account and provide Limit ? | (1) 15/20 minutes if transferred through www.achiieversequitiesltd.com (2) Inform CSS through mail or call if transferred through RTGS / NEFT & (3) Instant through NOW terminal if trasferred through Axis Bank . More banks are in pipeline for enlistment in NOW Terminal | |

| Fund Transfer | Will my position get cut if I cannot do fund transfer on time due to unaviodable circumstances ? | You are requested to contact to the dealing terminal or customer care immediately if you are unable to transfer fund due to some unavoidable circumstances. | |

| Fund Transfer | How do I withdraw Fund? | You can put withdrawal request from your back office login id or can mail in pay@achiieversequitiesltd.com or customer.care@achiieversequitiesltd.com | |

| Fund Transfer | How to place Payout Request ? | You can put withdrawal request from your back office login id or mail to pay@achiieversequitiesltd.com or customer.care@achiieversequitiesltd.com | |

| General | How is Achievers Equities brokerage so low ? | We keep our cost under control and do not indulge in lavish expenditures, foreign trips, costly offices. Every money saved is passed on to clients and utilised for client servicing. | |

| General | Who are the owners and part of management ? | Kindly visit our website. | |

| General | How long is Achiievers Equities in the Securities Market ? | We are in Equity market from 2010 & commodity market from 2008…for details visit our About US page in our website www.achiieversequitiesltd.com | |

| General | Achiievers Does not have office in my city ? How do I get service support in case of downtime? | You can directly contact to our customer support or dealing terminal or IT department in case of downtime. | |

| General | How do I trust, that my money will be safe with Achiievers? | There are many things that are already in place to ensure that your funds are safe. Here are a few key main things to remember : 1. All brokers have to deposit a certain amount of money to be kept with the NSE and MCX to become membershttp://www.nseindia.com/membership/content/fees_depst_n_net_req.htm

http://www.mcxindia.com/membership/feestructure/feedepositstructure.htm This is to ensure capital adequacy and a minimum net worth policy. 2. Client funds have to be kept in a separate bank account. A broker cannot mix client and pro funds together in any way. 3. Every year, the exchanges perform a thorough audit spanning several days. They check when funds came in from clients, how much is with the broker, what they were used for, and many other detailed compliance checks. We have passed their check every single year. 4.To maintain Transperency between us and our clients we have declared to SEBI and all the Exchanges that we dont endulge in any Properitory Trade. 5. Our calls are on a recorded line. If the broker places an order on behalf of a client, he must have proof of doing that. Using NSE NOW ensures clients that they can double check who placed the order by directly calling the exchange. 6. Investor Protection Fund – Part of your transaction fees charged by the exchange go to this fund which is to help clients recover losses in case of electronic, systematic or other non-client related failures. This is maintained by the NSE/BSE/MCX.Furthermore, if you are on our website you can click on our registration numbers on the bottom of every page to see our SEBI and FMC registration certificates.As a regulatory requirement, we need to keep a few crores as a deposit with each exchange to become a licensed broker. We have also completed all the formalities required to be a broker. If you are still skeptical you can start by opening a small account with us and then gradually building on it. |

|

| General | If the exchange settles a contract on its own, is the client required to pay any other charges? | Clients has to pay the taxes as per the settlement transaction type. | |

| General | In case the market falls rapidly in Intraday and I have some positions open, what control measures does the risk team take? | Our RMS team will contact you or your Authorised person directly for any abnormal situation. If MTM loss exceeds 70% the same day position will be squarred off from admin terminal. Please click here for our RMS policy | |

| NSE NOW | What is the NSE NOW Web Platform? | NOW Web Platform is a browser based trading interface. It allows you to trade online by logging in to www.nowonline.in or at www.now-online.in. NOW offers many of the functionalities available on the stand-alone Windows platform. The advantage is that you don’t have to install any software on your PC and you can access it from anywhere! Achiievers offers NSE NOW free of cost for all clients. | |

| NSE NOW | Where does my fund transfer reflect in NOW Trader? | Your transferred amount will be added as your margin & you can check the same from RMS view limit in NOW system. | |

| NSE NOW | How to place an order on NOW Trader? | A Small Flash Player video should display the same.” | |

| NSE NOW | What are the various platforms you provide? | We provide NSE NOW trading terminal for NSE, BSE & NSE Currency & ODIN terminal for Commodity ( MCX ) segment. | |

| Password | How do I receive the log in ID and password for the first time? | After we complete the account opening formalities we would send an email to your registered email id with all details. You will also get a Welcome letter with these details. | |

| Password | Is there any specification of password? | The password will be system generated & a combination of Letters & Numericals. | |

| Password | Can the login ID and the password of the client be the same? | Login id & password will be different for all, as it is system generated. | |

| Password | Am I required to change the password after first login? | You can keep the same password but it is suggested to change the same for security purpose. | |

| Password | My account is disabled. Why? | You might have forgot your password or typed wrong password. To reset the password you have to mail in customer care or click the Forgot you Password link. | |

| Password | How do I change my password? | You can change the back office or trading software password after login with the existing password. | |

| Password | Can the last two passwords be same? | No, you have to provide separate password. | |

| Password | Can I change my password any time? | Yes, you can change your password anytime. | |

| Password | Can I unlock the online trading login password? | No, you can’t unlock the same, you have to mail us to reset password. | |

| Research Support | Will I be offered research reports to help me take investment decisions? | Yes , you will get the research report at your registered mail id. | |

| Research Support | What type of research reports willl be offered to me? | You will get Daily Morning Outlook on Equity & Commodity , Fundamental Research Report & Weekly / Monthly calls on your registered mail id with us. | |

| Research Support | Will I get alerts from Achiievers Equities ? | You will get SMS alert on your trade details & ledger balance at your registered mobile number with us. | |

| Research Support | Can I get recommendations on SMS daily | Yes you can get our Research recommendation on SMS by paying only Rs 75/- per month for each segment. For details please contact our customer care. You can download the form from our website. | |

| Share as margin | What is Shares as margin ? | You can place your idle shares held in your Demat account with us in our Margin account as collateral to avail trading margin after 50% haircut. | |

| Share as margin | How can I use this facility? | You have to fill up a form & provide us the details of shares to transfer to margin account. Please contact customer care for details. Click here to download the form. | |

| Share as margin | What are the benefits of Shares as Margin ? | You can place your idle shares held in your Demat account with us in our Margin account as collateral to avail trading margin after 50% haircut. | |

| Share as margin | In what all segments the benefit of Shares as Margin can be used? | You can use the share as margin facility in Equity cash & derivative segment. | |

| Share as margin | How can I deposit the shares as collateral? | You have to fill up a form & to provide us the details of shares to transfer to margin account. Please contact customer care for details. Click here to download the form. | |

| Share as margin | How much limits do I get against shares deposited? | You will get share valuation as margin after deduction of 50% haircut. | |

| Share as margin | Can I get collateral limit on all shares? | We have an approved list of shares which you can use as collateral & it is updated on monthly basis. You can check the same from our website under RMS section. | |

| Share as margin | How the eligible trading limit is calculated against collateral deposited? | You will get share valuation as margin after deduction of 50% haircut. | |

| Share as margin | Is there any maximum quantity with respect each company security, up to which the client can deposit collateral? | No , there is no such limit but it has to be in guidance of SEBI and exchange guideline | |

| Share as margin | What about MTM, Brokerage and Other Charges. Whether the same can be adjusted against the limits received from collaterals? | You need to make the payment before pay in date in case of position taken against share as margin. | |

| Share as margin | Who will receive the benefit for various corporate actions like Bonus, Dividend and Right Issue? | The benefits of corporate actions like Bonus, Dividend & rights will be transferred to you as per your holdings on the record date. | |

| Share as margin | Will I get limits under Cash or Margin segment? | You will get the limit based on your ledger balance & share in margin account. | |

| Share as margin | Where can I view all securities deposited for trading limits? | You can check the same from your back office login id. | |

| Share as margin | Can the limits against the securities deposited change every day? | The hair cut rates will be based on the closing rate of the shares. So it can change on daily basis. | |

| Share as margin | What will happen to the shares deposited against trading limits? | You will avail the limits against the share deposited, you can sell the shares any time or can transfer the shares to your demat a/c by with drawing the share as margin facility. | |

| Share as margin | What will be the treatment of sales proceeds? | The sale procees amount will be credited at your trading ledger & you can withdraw the same after pay out date or use the balance against your trading limit. | |

| Share as margin | If I withdraw the shares deposited, will it affect the trading limits? | Yes, your trading limit will be reduced accordingly, you will get the limit only against your ledger balance. | |

| Share as margin | Is there a limit on the no. of requests I can place for withdrawal of securities deposited? | No, there is no limit. | |

| Share as margin | Can I buy shares using the collateral limit? | Yes you can buy | |

| Technical | How do I download NOW Terminal ? | You can download NOW software from our website under download section. | |

| Technical | What is the minimum computer specification required to download NOW terminal ? | You need an Internet connection with high speed & Windows operating system | |

| Technical | How to download latest NOW version and other supporting apps like Flash Player, etc? | You can download NOW software from our website under download section & for any assistance you can contact our IT department at 03366063012/3046. | |

| Trade on Phone | What is Trade-on-Phone service? | Trade-on-Phone service facilitates placing of Order through a dealer. This is absolutely free of cost. | |

| Trade on Phone | How do I activate Trade on Phone service for my account? | It is free facility for all clients and they can call our customer service desk number and select the trading option to speak to a dealer for placement of orders. | |

| Trading | Till what time can I place an ‘Intraday’ order? | You can place the order till 15 minutes before the closing of market. | |

| Trading | Is there a time limit within which I am supposed to square off the position I have taken today? | Yes, you have to square off the same day position before 15 minutes of closing of market. | |

| Trading | Where can I find margin limits? | You can check the limit from NOW trading software itself under Surveillance >RMS view limit option. | |

| Trading | What is the time taken to transfer shares from another demat account to your pool account? | You can transfer shares from other demat to your demat with us by filling up the same day or next day instruction slips. | |

| Trading | How much exposure (limit) will I get in different segments? | o Equity Intraday Margin : 5 Timeso Equity Cover Order : 20 to 30 Times Approx

o Futures : 2 Times o Future Cover Order :- 4 Times Approx o Commodity : 4 Times o Currency : 2 Times o Options : As per actual margin |

|

| Trading | I place an order to buy 5 lots, what if it gets traded 5 times 1lots per trade? | 1. In our MVP plan no separate brokerage will be charged per lot. 2. In our Rs 15 per order brokerage scheme only Rs 15 will be charged against 1 single executed order irrespective of the break up of order in multiple trades. 3. In our normal brokerage scheme the per lot brokerage will be charged as per the selected rate by client. | |