Market Commentary

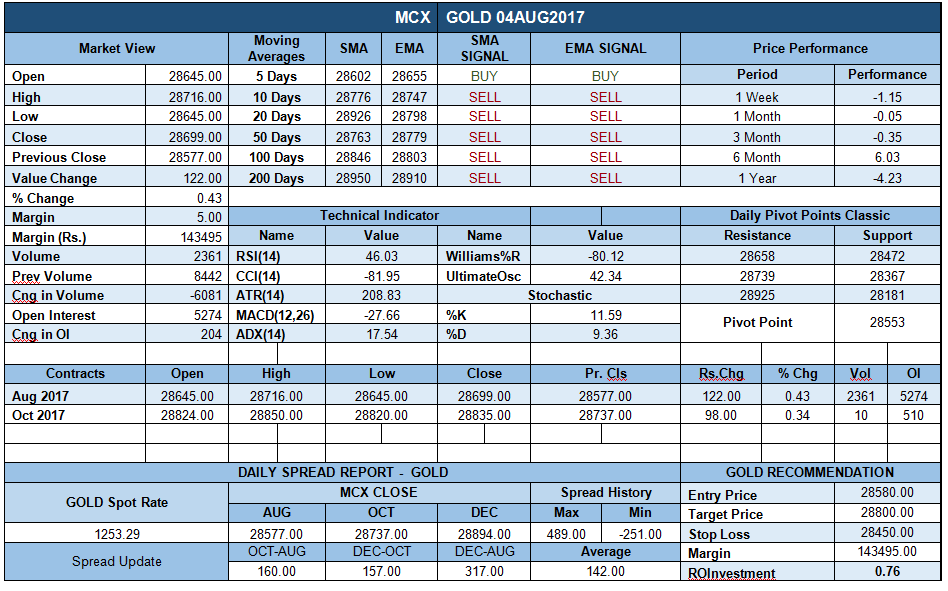

Gold on MCX settled up 0.18% at 28577 prices paused after a recent downtrend gained in yesterday session marginally but still holding near 5-week lows in the absence of market-moving economic data. The dollar wobbled a bit in yesterday’s session, allowing gold to find its footing. Gold’s safe haven value was also boosted by signs that markets will be vulnerable to the collapse in crude oil prices. Gold prices has come under pressure since last Wednesday as the Federal Reserve unexpectedly hinted it is determined to raise interest rates once more in 2018 and three times in 2018 despite an economic soft patch. From data point yesterday dollar failed to capitalize on upbeat housing data, as the National Association of Realtors said strong demand and inexpensive mortgages were driving up prices at an unsustainable rate, as sales of existing homes rose 1.1% in May to an annual rate of 5.62 million. Sentiments support can be seen as SPDR Gold Trust GLD said its holdings rose 0.04 percent to 853.98 tonnes on Wednesday from 853.68 tonnes on Tuesday.

From India Rural demand for gold has dropped 30-40% over the past fortnight as sowing has picked up across the country with the onset of monsoon. Farmers are busy buying seeds, fertilisers, tractors and other agricultural equipment but staying away from the yellow metal which is regarded as a key asset class in rural India. Technically market is getting support at 28472 and below same could see a test of 28367 level, And resistance is now likely to be seen at 28658, a move above could see prices testing 28739.

Trading Ideas

|

||||||||||||||

|

||||||||||||||

|

||||||||||||||

|

||||||||||||||

|

||||||||||||||

|

GOLD RECOMMENDATION |

||||||||||||||

| BUY GOLD AUG 2017 @ 28580 SL 28480 TGT 28680-28800.MCX | ||||||||||||||

Technical Chart